Is investing in L&D the best bet to outperform your competitors?

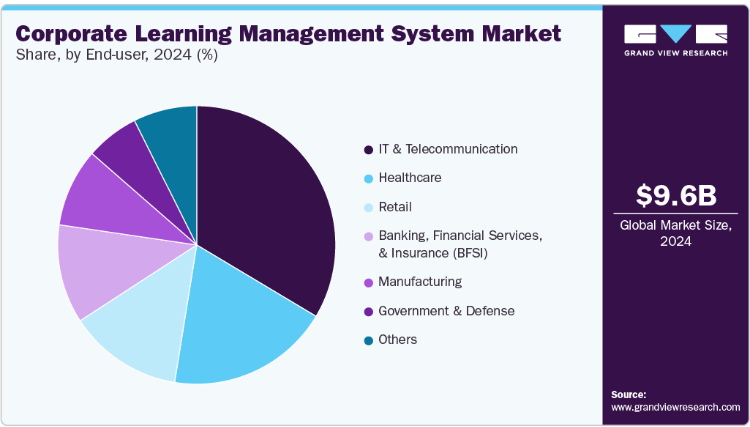

The corporate LMS market in the Asia-Pacific (APAC) region has been growing rapidly in the last decade. Both, government agencies and corporations – especially industries like manufacturing, retail, as well as finance, IT, Legal and other professional services – rely heavily on continuous employee training and development. There is a high demand for training in the healthcare, nursing and aged care sectors as well.

The global corporate LMS segment is expected to grow at 19.4% CAGR across 2025–2030, with the APAC region being the fastest growing market for corporate LMS. According to Grand View Research, some of the key reasons for this include:

- Cross border business operations

- Growing need for upskilling and reskilling employees, in line with digital transformation strategies, enhancing capabilities and gaining competitive advantage

- Employees’ growing expectations of having flexible, hybrid and on-the-go training available to them

Source: https://www.grandviewresearch.com/industry-analysis/corporate-learning-management-system-lms-market-report

Numerous studies have proven that investing in Learning and Development is directly linked to employee engagement and retention.

If money is the language of business, engagement is the language of motivation — and only through motivation does anything in business get done – Gallup

However, despite on the job training spend rising overall, one in eight Australian businesses claimed to cut their L&D spend by as much as 50% in 2024; and those that maintained or increased their L&D spend, have not quite hit the mark with their offerings.

RMIT Online and Deloitte Access Economics report shows that 64% of employees surveyed in their 2024 study, agree that businesses are not doing enough to address skill gaps; and 70% would like their employer to invest more in their learning and development. The same report confirms that 1.8 million new tech skills will be needed by 2030, with four of the top five skills gaps being digital-related.

In professional services industries especially, attracting and keeping the best talent, and improving your employee value proposition (EVP), are the key drivers of business resilience and growth. While in many cases, the ROI on L&D spend is significantly underestimated.

Employee training really “pays off twice” says Ben Rand of Harward Business Review (HBR, 2026). “Evidence from a 16-week program at a Columbian government agency had shown that upskilling boosts not just employees’ productivity, but the output of their managers too.”

“Beyond improving staff productivity and retention, the hidden value of training lies in how it unlocks managers’ time to focus on strategic work [as help request emails decline]”, says Harvard Business School Professor Christopher T. Stanton, one of the study’s co-authors. “The extra time managers gained back, amounted to nearly half of the total benefits of the training program.” (Source)

In light of Manager-level staff declining engagement and burnout, organisations have to be mindful of both, (direct) managerial and (indirect) frontline worker training benefits, and the accumulated ROI of both.

A 2022 research by DeakinCo. in partnership with Deloitte Access Economic found that every $1 invested in L&D per employee is associated with an additional $4.70 in business per employee on average. The report stated that 87% of businesses in Australia could do more to improve their L&D, while only 13% were found to be leaders in the space. (Source)

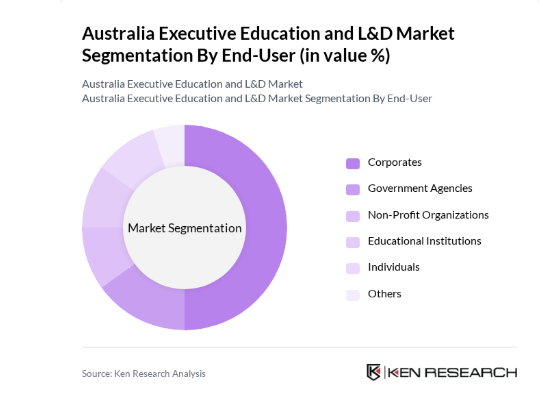

According to Ken Research, the major adopters of Executive Education and L&D in Australia are the Corporates, followed by Government, Non-for-profit and Education Providers.

Image source: https://www.kenresearch.com/australia-executive-education-and-ld-market

The Challenges

Even if, in theory, many organisations understand the value (and increasing demand for) better L&D programs and well-managed corporate learning management systems (LMS), it may seem like a daunting task to keep up to speed with those initiatives. The rate of digital transformation is accelerating at an unprecedented rate thanks to AI, Cloud and hybrid working environments – all are now expected to be beyond experimentation phase and embedded in practice in all progressive companies.

Complex, matrixed structures, with diverse regional or department based needs are other growing challenges many larger companies are facing.

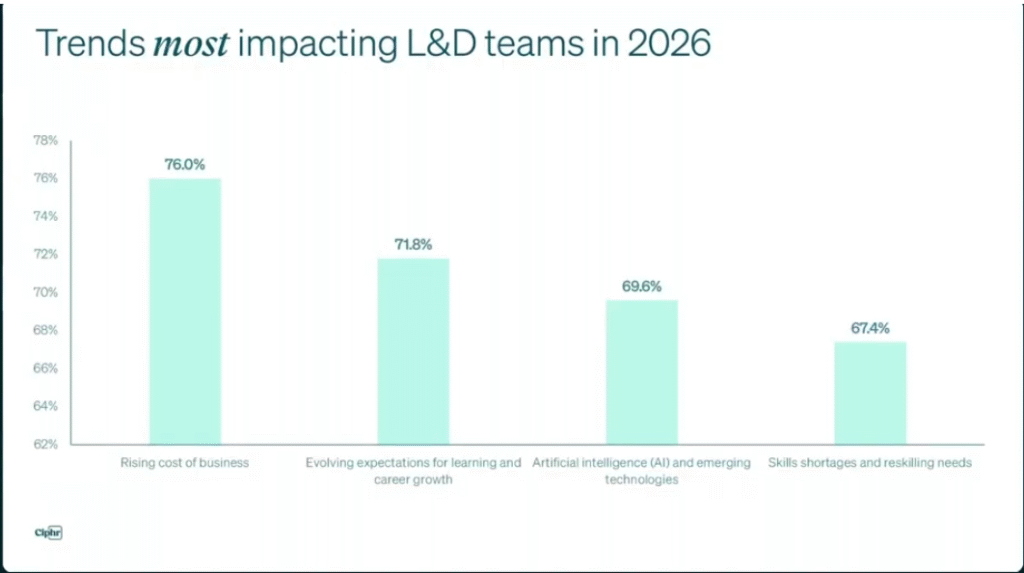

The greatest challenge of all, however, is the rising cost of business and budget limitations.

Blanchard Australia’s 2025 HR and L&D Trends Survey results confirmed that the biggest challenges for Australian businesses fall into 7 key themes:

- Talent Acquisition and Retention

- Budget Constraints / Resource limitations

- Adapting to technological change / AI adoption

- Leadership development

- Employee engagement

- Change management

- Skills development

and a study in the UK by Ciphr has shown similar trends:

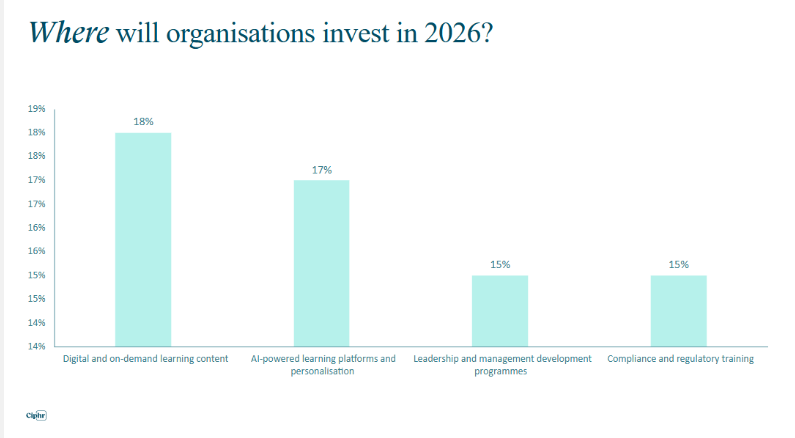

Source: https://www.ciphr.com/blog/ld-trends-2026

The Opportunities

To meet employees evolving demands, and to develop (and keep!) high performers, businesses need to:

- Build capable leaders that can drive positive change

- Regularly review and improve L&D programs and course materials, to increase engagement and encourage the culture of learning

- Invest in scalable, flexible and accessible learning management systems with robust analytics and ai driven automation

When CEOs successfully connect skills and technology strategy to long-term business model reinvention, there’s an opportunity to supercharge productivity and reimagine revenue streams. – Kevin Burrowes, PwC Australia, 20 Jan 2026

Generative AI should really be moving from experimentation into practical applications, automating various ‘low value tasks’ as much as possible. While robust analytics processes and tools are critical to being able to identify gaps quickly, adjusting programs and systems accordingly and without delay.

- Be transparent about the current challenges and ensure everyone understands how they contribute to overall company success

- Adopt a skills-first strategy

2026 Skills Impact Report by 365 Talents suggests organisations adopt a “skills-first strategy”, making job-readiness an organisational KPI.

Employability when quantified, becomes a leading indicator on business resilience and includes:

– skill progression over time

– gap closure rate between current and strategic skills

– internal mobility and reskilling activity

– retention linked to learning and development

“It’s a mutual investment,” the report states. “Employees invest in learning and adaptability, and employers invest in visibility, tools and opportunities to grow.”

Source: https://365talents.com/en

How to continue to improve L&D when you have budget constraints?

To improve their L&D strategies in the face of tighter budgets, companies need to get creative.

Ciphr study shows that using AI to personalise learning and drive analytics, embedding continuous learning through micro-learning and maximising accessibility are some of the key things L&D teams in the UK are likely to focus on in 2026; while Sara Vukasinovic, Corporate Education Consultant at Upskilled, Australia, recommends the following 7-step strategy to maximise your training budget:

- Tie training to your annual business goals: Make “learning-to-impact” explicit: pick 2-3 metrics (e.g., cycle time, customer escalations, incident rates) and align programs accordingly. This is L&D’s #1 focus area and the easiest way to keep budget protected.

- Segment your portfolio (Must/Move/Morph): “This mirrors why Australian employers choose accredited training and where unaccredited learning fits,” says Sara.

- Must: compliance, WHS, licensing (use accredited units; leverage RTO assessment for auditability).

- Move: near-term performance lifts (leadership foundations, project skills, customer excellence).

- Morph: future-proofing (AI literacy, data, cyber basics).

- Blend formats to reduce cost-per-outcome: Use microlearning, practice labs, and manager-led coaching around a few high-impact workshops.

- Quarter-back your spend: Ring-fence budget by quarter (e.g., 35%/30%/25%/10%). Lock Q1–Q2 cadences for core programs; keep a Q3 “skills accelerator” for AI/data and a small Q4 contingency for unavoidable compliance or staff turnover.

- Ensure your training partner is flexible and aligned with your goals.

- Measure what stakeholders care about: Move beyond completions/CSAT. Track time-to-competency, incident reduction, rework, conversion rate, average handle time, or internal mobility moves. These are the business improvement metrics L&D teams are shifting toward.

- Pick the right delivery partner(s)

Read more here: https://www.upskilled.edu.au/skillstalk/new-fy-new-skills-how-australian-companies-are-spending-training-budgets

The fact that the APAC region is the fastest growing market for corporate LMS is an excellent indication that Australian companies in both, private and public sector understand the value of enhancing their teams’ capabilities to gain competitive advantage. The real challenge is to stay two steps ahead of your competition. In that, point 7 above – choosing the right delivery partner(s) – learning designers, education providers, LMS and technical support services cannot be underestimated.

By working with an integrated network of various experts you will understand and achieve your desired outcomes quicker; and will be able to build a digital ecosystem that will help your people and your business to thrive.

Here is what to look for when selecting your e-learning support partner – read here.

Catalyst IT specialises in enterprise level LMS servicing health and corporate sectors, as well as government agencies, non-for-profits and universities.

Further reading:

AHRI Research: The Evolving Skills Landscape – Australian HR Institute report, June 2024

Australia Executive Education and L&D Market report – Ken Research, 2024

Budgeting for Learning and Development – National Training, 25 July 2025

Continuous education and employee engagement – Catalyst IT Australia, July 2025

Corporate Learning Management System Market (2025 – 2030) Report – Grand View Research

Doing more with less: 10 Practical Strategies for High Impact L&D, Giles Hearn, LPI, 8 May 2025

Employee engagement and Performance: Latest insights from the World’s Largest Study, Gallup, 2020

Employee engagement is sill on a slippery slope – Catalyst IT Australia, May 2025

Highly Capable, Future Ready: APS Learning & Development Action Plan – Australian Public Service Commission, 20 July 2021

Investing in L&D increases retention – Shandel McAuliffe, 13 April 2022

Leaders Identify Top HR and L&D Challenges 2025 – Blanchard Australia

Media Release: $4.70 revenue gain per employee for every $1 invested in L&D – DeakinCo, 3 March 2022

L&D predictions for 2026: the trends shaping learning and development – ILX, 9 December 2025

L&D Trends 2026: challenges and rends to watch out for – Charlotte Chadwick, 6 January 2026

New FY, New Skills: How Australian companies are spending training budgets, Sara Vukasinovic, Upskilled, 9 September 2025

PwC’s 29th Global CEO Survey – PwC Insight, 20 January 2026

The Path to Sustainable Generative AI Value Balances Passion, Pragmatism and Patience – Deloitte, 21 January 2025

Training cuts will cost Australian businesses $2bn this year – Accounting times, 21 March 2024

Unraveling the Puzzle: Why companies often fail at Learning and Development, Ashley Brici, 28 March 2024

Why Training Employees Pays Off Twice, Ben Rand, HBR 16 January 2026

2026 Skills Impact Report – 365 Talents

11 HR trends Australian employers muct know in 2025 – The Rippling Team, 5 August 2025